Key Insights:

- Nvidia and TSMC encounter production issues with next-gen Blackwell AI chips, threatening delays.

- Tech giants like Microsoft and Google face potential AI chip shortages amid high demand.

- Analysts suggest minor tweaks and short-term revenue impacts, but long-term AI growth remains strong.

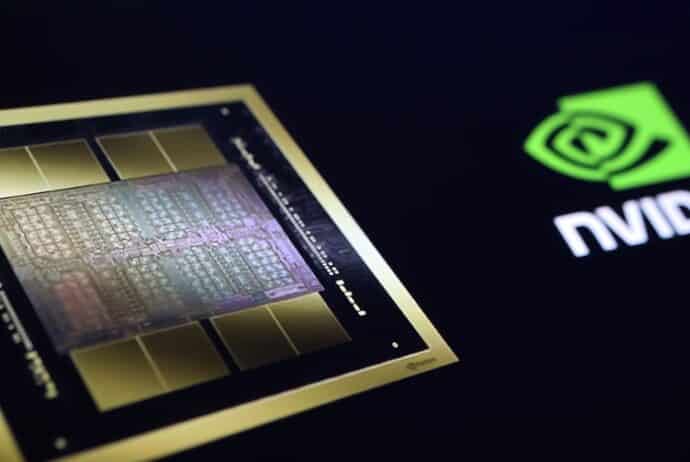

Nvidia and Taiwan Semiconductor Manufacturing Company (TSMC) are encountering production issues with Nvidia’s next-generation AI chips. This has raised concerns about potential delays in shipments scheduled for this year.

According to sources familiar with the matter, Nvidia’s new designs, which employ TSMC’s latest manufacturing process, have encountered complications with certain models in the upcoming Blackwell series of data center chips.

The anticipated delay has had immediate financial repercussions. Amid a broader market sell-off, Nvidia shares dropped as much as 15% in early New York trading on Monday, while TSMC’s stock fell 10% on the Taiwan exchange. By noon, Nvidia’s loss had moderated to 6%.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Surpass the competition with this cutting-edge AI system! Utilize the prowess of innovative algorithms and amplify your crypto trading strategies with CypherMindHQ. Learn more today!

Impact on Tech Giants and AI Start-ups

Several major technology companies, including Microsoft, Google, Meta, Amazon, and AI start-ups such as OpenAI, are heavily reliant on Nvidia’s latest chips for advancing their AI systems. These companies are investing substantial sums in AI infrastructure, with analysts projecting up to $1 trillion in data center spending over the next five years to support AI development.

However, recent Wall Street sentiment has become cautious regarding the sustainability of the AI boom. Nvidia’s market value has dropped by about $750 billion since mid-June when it briefly became the world’s most valuable company. Hedge fund Elliott Management expressed skepticism in a letter to investors, labeling Nvidia and other major tech stocks as being in “bubble land” and describing AI as “overhyped with many applications not ready for prime time.”

Engineering Hurdles and Manufacturing Bottlenecks

The transition to mass production of Nvidia’s Blackwell chips has encountered significant engineering hurdles. A source familiar with the manufacturing process noted “difficulties” related to the interposer, a crucial component that connects different dies in complex AI chips. Nvidia has not commented on the specific issues but reiterated that “Blackwell sampling has started and production is on track to ramp up to mass production in the second half of 2024.” The company added that the demand for existing Hopper chips remains “very strong.”

TSMC, Nvidia’s exclusive manufacturing partner and the world’s largest chip producer, is facing its own challenges. The company has struggled to scale up its most advanced production technology to meet the burgeoning AI chip demand. During TSMC’s second-quarter results announcement, CEO CC Wei mentioned that balancing demand and supply might only be achieved by 2025 or 2026, rather than by the end of this year as initially projected.

Analyst Perspectives and Future Projections

Market analysts suggest that Nvidia might need to implement minor design tweaks to resolve the production issues. Mark Li, a semiconductor analyst at Bernstein, mentioned that such adjustments are likely necessary. BNP Paribas analysts estimate that resolving these issues could take two to three months.

Despite the immediate challenges, they do not foresee a change in the mid- to long-term outlook for Nvidia or AI adoption. However, they note that the delay could benefit Nvidia’s competitor, AMD.

Citi analysts indicated that the production delays could reduce Nvidia’s data center revenues by up to 15% in the quarter ending January. However, they also suggested that sales might rebound in the subsequent period as a result.

Adjustments and Industry Outlook

As Nvidia navigates these production challenges, it underscores the complex nature of advancing AI chip technology. The Blackwell chips are expected to be twice as powerful for training AI models compared to their predecessors. Nvidia CEO Jensen Huang had previously stated that the company anticipated substantial Blackwell revenue this year, and engineering samples have already been shipped.

CypherMindHQ.com Artificial Intelligence Crypto Trading System - Outpace the competition with this high-end AI system! Leverage the capabilities of progressive algorithms and enhance your crypto trading performance with CypherMindHQ. Learn more today!

Despite the hurdles, the demand for advanced AI chips remains robust. The industry is experiencing a capacity bottleneck, particularly in advanced packaging, the final production stage for sophisticated chips.

Editorial credit: Ralf Liebhold / Shutterstock.com